"The First Wave of Option ARM Casualties"

From BusinessWeek:

For cash-strapped homeowners, it was a pitch they couldn't refuse: Refinance your mortgage at a bargain rate and cut your payments in half. New home buyers, stretching to afford something in a super-heated market, didn't even need to produce documentation, much less a downpayment. Those who took the bait are in for a nasty surprise. While many Americans have started to worry about falling home prices, borrowers who jumped into so-called option ARM loans have another, more urgent problem: payments that are about to skyrocket...

After prolonging the boom, these exotic mortgages could worsen the bust. They also betray such a lack of due diligence on the part of lenders and borrowers that it raises questions of what other problems may be lurking. And most of the pain will be borne by ordinary people, not the lenders, brokers, or financiers who created the problem.

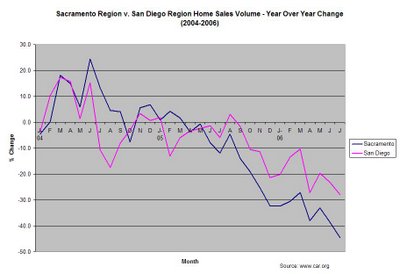

Gordon Burger is among the first wave of option ARM casualties. The 42-year-old police officer from a suburb of Sacramento, Calif., is stuck in a new mortgage that's making him poorer by the month. Burger, a solid earner with clean credit, has bought and sold several houses in the past. In February he got a flyer from a broker advertising an interest rate of 2.2%. It was an unbeatable opportunity, he thought. If he refinanced the mortgage on his $500,000 home into an option ARM, he could save $14,000 in interest payments over three years. Burger quickly pulled the trigger, switching out of his 5.1% fixed-rate loan. "The payment schedule looked like what we talked about, so I just started signing away," says Burger. He didn't read the fine print.

After two months Burger noticed that the minimum payment of $1,697 was actually adding $1,000 to his balance every month. "I'm not making any ground on this house; it's a loss every month," he says. He says he was told by his lender, Minneapolis-based Homecoming Financial, a unit of Residential Capital, the nation's fifth-largest mortgage shop, that he'd have to pay more than $10,000 in prepayment penalties to refinance out of the loan. If he's unhappy, he should take it up with his broker, the bank said. "They know they're selling crap, and they're doing it in a way that's very deceiving," he says. "Unfortunately, I got sucked into it." In a written statement, Residential said it couldn't comment on Burger's loan but that "each mortgage is designed to meet the specific financial needs of a consumer."